Some investors (most famously, Warren Buffet) buy the stocks that they consider to have good value and hold them forever. Others try to time the market’s bull and bear cycles or sell when a certain asset reaches a price high enough to tempt them to sell it. And then there are Day Traders, people who dedicate significant time to actively trading stocks to try to get the most profit out of each trade. It may be only a few hours a day or it may be the equivalent of a full time job with overtime. But wait, can you day trade crypto? Of course you can! Crypto day trading is a very active community.

How to Day Trade Cryptocurrency

Day trading crypto is fundamentally not much different than trading stocks, bonds, or ForEx. But it is different enough. One notable difference is that crypto trades 24/7, so the window for your “perfect trade” is always open – just choose the best crypto to daytrade. As in any trading, your path starts with two simple choices: platform and assets.

Choose a platform to trade

Choosing a platform to trade crypto is not an easy task. There are thousands of centralized and decentralized exchanges, plus various online brokerages that include crypto among their offerings. Which are the best crypto exchanges for day trading? CEXs have the familiar tools of the day trader, such as the order book, various limit orders, and instant liquidity (if you’re just trying to figure out how to day trade bitcoin, it may be enough). DEXs give you access to a bigger variety of cryptos, pull liquidity from all over, and are generally not forcing you to deal with KYC procedures. Of course, having a dedicated crypto trading terminal like Kattana helps you cut through the noise (maybe that’s why so many traders consider Kattana the best cryptocurrency exchange for day trading?).

Choose your investments

Just like with stocks and currencies, choosing the best crypto to day trade is an important consideration. Day trading bitcoin or ethereum is like day trading your typical “blue chips” preferred by most day traders. But if you only trade them, you could miss out on the wild short-term swings and longer-term rallies of more speculative or even “meme stock” cryptos like ADA and SHIB. The risk/reward correlation is generally the same in crypto as elsewhere. Often, the choice of assets you trade will determine the choice of platforms to trade on: make sure your trading platform of choice has sufficient liquidity of the assets you are interested to trade in.

Day Trading Crypto Strategies

Once you’ve decided on the what and the where, what remains is how: your crypto trading strategy. There are as many cryptocurrency trading strategies just like in stock trading, with most of them being the exact same ones. Let’s go over some of the most popular ones to maybe find you a cryptocurrency trading strategy that feels right for you.

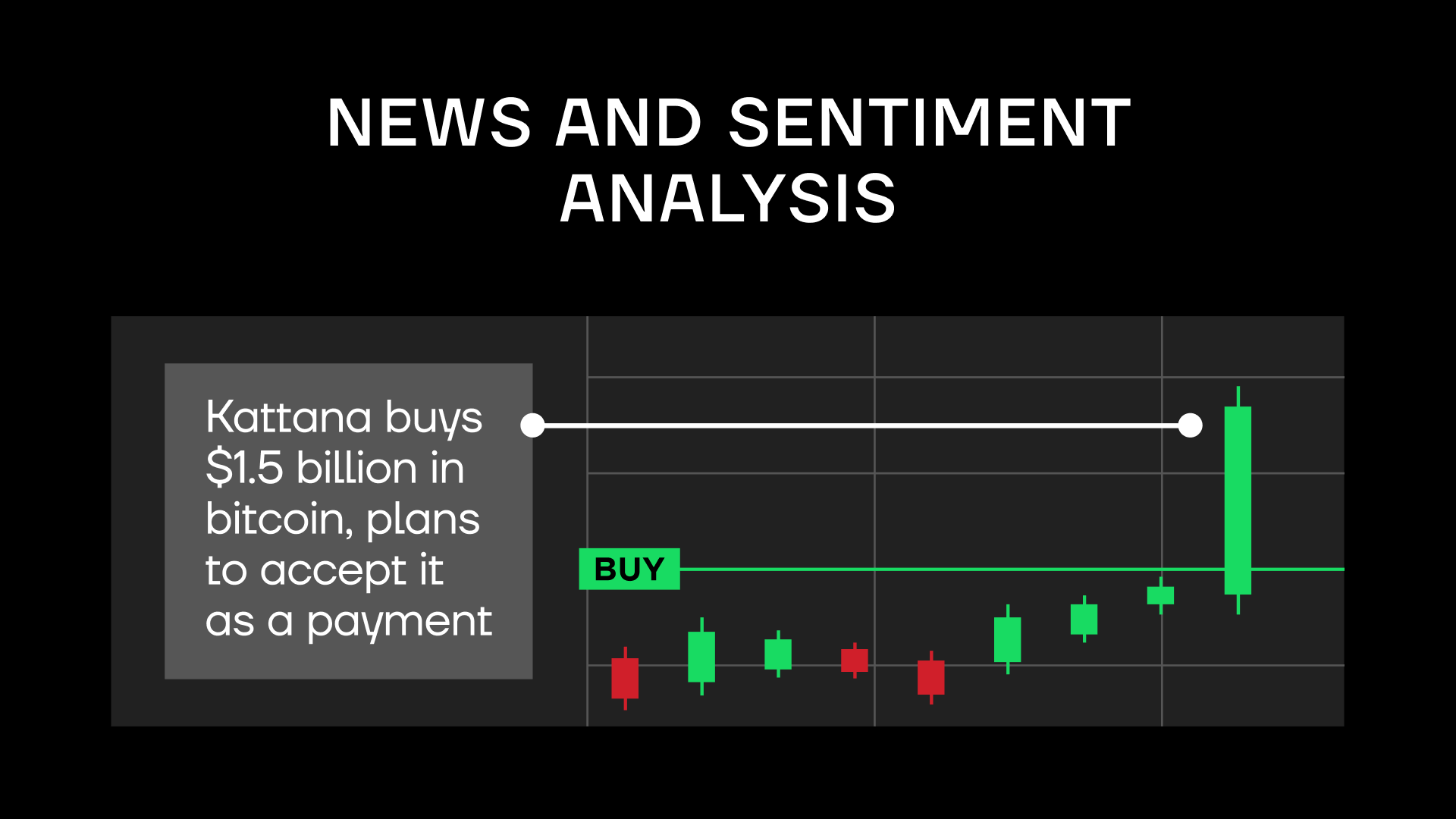

1. News and Sentiment Analysis

If you’re not a technical trader but understand humans, your crypto daily trading strategy may consist of analyzing relevant news about the market and your cryptos of interest and trading accordingly. With enough training and experimentation, you should be able to gauge the sentiment among the public and the crypto’s holders more specifically.

Maybe a project has its mainnet coming out in a month and there is enough excitement to reasonably predict a price spike before or right after the announcement of the mainnet going live. Maybe another project just got listed on a small exchange and is expected to get listed on one of the big ones like Binance or Coinbase. Conversely, if the hype is already priced in, you may want to short the crypto in anticipation of the pullback. The classic: “buy the rumor, sell the news” strategy.

Or maybe it’s more macro news. If the U.S. Federal Reserve is about to announce a big interest rate hike and you can see the writing on Wall Street that the stock market is about to take a dive with crypto falling in tune, you can use that to short anything from blue chip cryptos to the most speculative ones whose earlier rally far overextended itself. You can look at the broader economic and social trends. Just as Peloton, Zoom, and Robinhood stocks followed their spectacular COVID-years growth with an even more spectacular collapse, plenty of cryptos have done the same. Do your research, analyze the news, and make your trades. With practice, you’ll pull daily crypto trading tips out of the news (mainstream or niche, like the day trading crypto reddit).

2. Scalping

Scalping is probably the most adrenaline-filled form of a crypto day trading strategy. The main assumption is that stocks generally make quick up/down moves all the time, regardless of their long-term trajectory. With enough discipline and very quick action, a scalper day trading bitcoins or altcoins executes hundreds or even thousands of trades per day, attempting to grab a tiny profit with each one and thus have a significant profit at the end of the day.

Obviously, no trader can profit off every trade. A single big loss can wipe out an entire day’s profits (or worse). This is why a scalper needs to have very tight and consistent stop loss orders or manual exits if his trade has an unacceptably high loss. Thus, a scalper needs to be very unemotional and quick. Though, to be fair, all traders should leave their emotions at the door.

Crypto tends to be more volatile than assets like stocks or bonds. A 3% daily drop in the S&P makes headlines but a 3% drop in ETH is your regular Tuesday. This higher volatility makes crypto more attractive to scalpers.

3. High-Frequency Trading (HFT)

If scalpers can make thousands of trades only with high concentration and much energy expenditure, HFT traders can make tens of thousands of trades without batting an eyelash. This is because a high frequency trading cryptocurrency strategy is dominated by algorithms, the machines calmly doing what human traders program them to do.

HFT is the favorite trading method for hedge funds and institutions who don’t want to manually figure out how to day trade bitcoins — and it is hated by retail investors because no human can match the analytical and execution speed of a machine. Algorithms can analyze trends in seconds and make a series of trades before humans even realize a trend is forming. As importantly, HFT algos are able to analyze bid-ask spreads exceptionally well and place trades at such precise bid-ask spreads as to give themselves a tiny advantage over other trades.

4. Bot trading

Crypto’s answer to HFT is bot trading. Even beginner programmers can create a trading bot. And some even sell bots to others, often willing to customize bots for the customer. Essentially, it’s like having an algo in your pocket. Code the bot, train the bot to trade specific assets on specific exchanges via a specific strategy and let it get at it!

Bots can be programmed to act on news and sentiments (after all, inputs are inputs), but it is more common to train them to look at technical indicators and price movements as triggers for action. Since your competitors can figure out what inputs your bot uses to trade, there is always the danger that someone will try to manipulate the inputs to manipulate bot behavior. Hence, it’s best to use inputs from the most reliable and hard-to-corrupt sources like Chainlink.

5. Technical Analysis

If you see a cryptocurrency day trading trader staring at a price chart for hours, switching between different indicators to try to predict price trends, congratulations — you’ve stumbled upon a technical analysis. It’s generally important for all traders, regardless of their trading strategy, to master the fundamentals of technical analysis. Even if you don’t believe in technical analysis accurately predicting price movements, it will at least give you an idea of what other traders are looking at. So when a price moves in a certain way that is explained by technical analysis, you’ll understand why so many traders are reacting to it in a certain way. In short, it’s a better way to understand price movements and trader actions. The best crypto day trading platform will have tons of TA tools for bitcoin day trading and altcoin day trading too.

The favorite tool of the technical trader is perhaps the moving average. If you look at TA trader discussions, you will see a lot of talk about 30-day MA, 200-day MA, and so on. If the different time range trading averages cross, it’s considered a major sign of price trend reversal. However, there are literally hundreds of TA indicators on platforms like TradingView. Kattana actually took many premium indicators traders normally have to pay for and made them available for free inside the terminal. Because technical analysis is fundamental to many types of trading.

6. Range Trading

Range trading is also called range-bound trading because it is based on the assumption that assets trade within specific price ranges based on their support (lower bound) and resistance (higher bound). When following a price chart of any asset, you will usually notice periods of sudden, somewhat sustained price movements up/down followed by periods of the stock trading mostly sideways, meaning that the price is mostly flat with only minimal movements up/down.

This is what they call range bound. An asset will generally stay within a certain range until it is ready to move out of it one way or another. A range crypto day trader focuses his attention on support and resistance lines and various chart patterns (head and shoulders, the golden cross, etc.) that may indicate that a new trend is forming and the asset may break out of the range. The big risk here is that an asset will break out of the range earlier than expected. So keeping a limit on potential losses and a close eye on the asset’s price action is important.

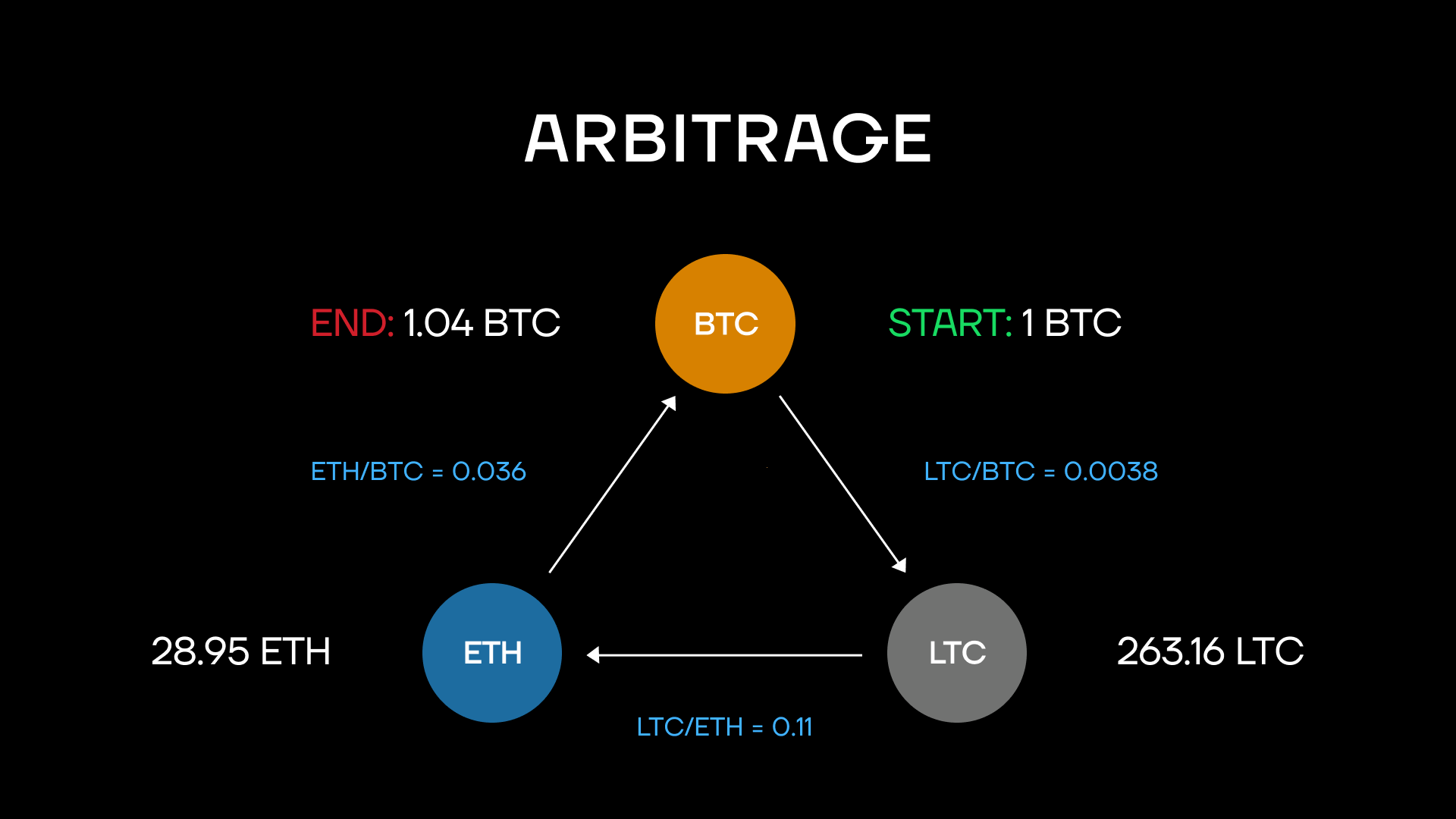

7. Arbitrage

Arbitrage is a buzz word now but was an especially effective strategy in the earlier days of crypto when different exchanges often had different prices for Bitcoin and other assets. Cunning traders would buy the asset where it was cheaper and sell it where it was more expensive, effectively executing the classic “buy low sell high” strategy using the pricing inconsistency between exchanges. Arbitrage still exists and could be quite profitable if spotted and executed quickly enough.

Arbitrage bots have been popular for a while in crypto. It’s certainly cumbersome to set up a bot to seamlessly work across exchanges and assets, but once done, the bot can quickly snipe an arbitrage trade before the price discrepancy is reconciled by the exchanges.

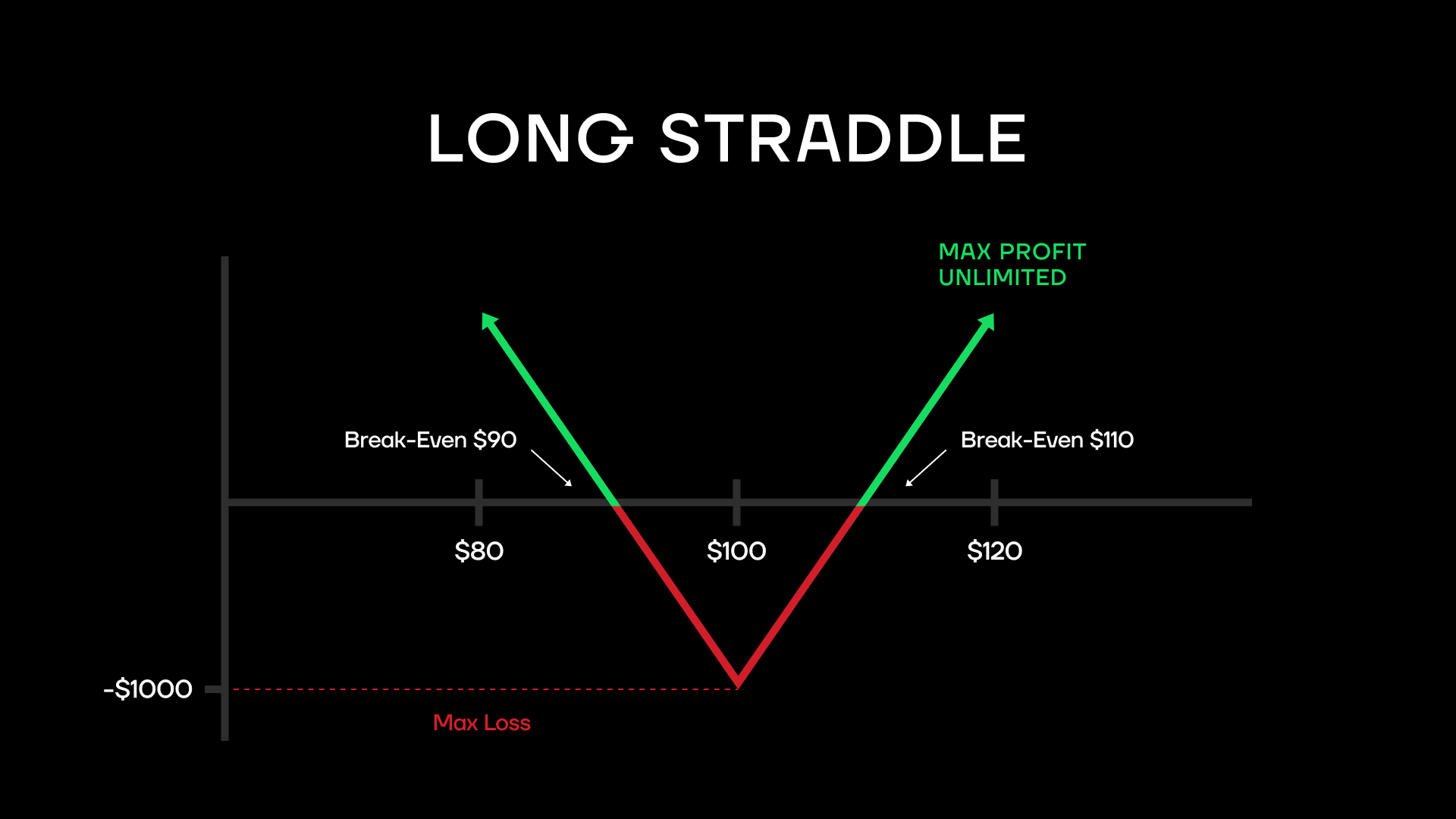

8. Long straddle

Because crypto is so volatile, the long straddle strategy makes a lot of sense. Generally, it is an options strategy, with the trader buying a long call and a long put with the same expiration date. If the asset doesn’t make any big move, the trader loses both options. But if it moves in a big way in either direction, the gain from one option will far exceed the loss from another.

There are various ways to execute this strategy. For example, you can long and short the same crypto with a high margin. Yes, you will be liquidated on one position, but you only need the opposite one to make more than 2x (if both initial positions were equal) to make a profit. Though you should be careful that both of your positions don’t get liquidated if your crypto of choice has sudden huge movements in both directions, which does happen.

Pros and cons of day trading cryptocurrency

Is day trading crypto worth it? Can I day trade crypto? Any day trading cryptocurrency strategy

Is only a tool. On the plus side, day trading can bring you huge profits in a short time span. But it can bring big losses if you’re not careful. If you want to be fully in charge and have an active role in managing your assets, day trading can provide you with the results and thrills commensurate with the time you put into it.

Mistakes to avoid while day trading

Even as we talk about the thrills of day trading, emotion is your #1 enemy. Stick to crypto day trading rules. Avoid changing your strategy too often. Be mindful of your biases and blind-spots. Even the best crypto platform for day trading is only a tool. Take your tie and learn how to trade cryptocurrency for profit. It takes time to learn trading strategy crypto or otherwise.