What is defi and why is it such a big deal? DeFi (or defi, de fi, de-fi) is shorthand for Decentralized Finance, which is the blockchain world’s answer to classical, centralized finance you may know from your bank, credit cards, and other institutions that handle financial matters.

No defi introduction is complete without talking about cryptoloans. Cryptoloans are just like regular loans with the twin major exceptions that a) they are not secured by the government but rather rely on a computer algorithm to work, and b) they can be made by anyone to anyone.

What Is Decentralized Finance (DeFi)?

Therefore, anything that is decentralized and deals with finance can be called defi meaning that it fits the intent and function of it. In addition to above mentioned loans, it could include money transfers, credit issuance, insurance, trading, and much more.

How Does DeFi Work?

Because it is not governed by central banks or government agencies, there needs to be another mechanism that makes DeFi crypto work as intended and without exploits. The main such mechanism are smart contracts, which are collections of code that automatically execute certain actions based on various inputs. If programmed well, smart contracts can run loan issuance and repayment, fetch asset prices via oracles, and much more.

How does defi work besides the backend? The other mechanism is human governance, necessary at the very least because code is so far far from perfect in running complex operations and making “gut” or morality decisions that humans are best equipped to handle.

What is a smart contract?

What is defi crypto cannot be answered without talking about smart contracts. Imagine writing a rule book that can self-enforce its rules. This is the smart contract in a nutshell, defi definition becoming defi execution. It can allow, prohibit, or modify a number of actions and behaviors among algorithms that in turn can run markets, provide access to funds, and much more. In DeFi, smart contracts can create platforms, NFTs, and many other things. They can also be exploited by hackers who dig through the smart contract code and try to find exploits that would “trick” the smart contract into giving them money that doesn’t belong to them or even letting them mint as much money as they want. So programming a smart contract needs to be done at the absolutely top notch level.

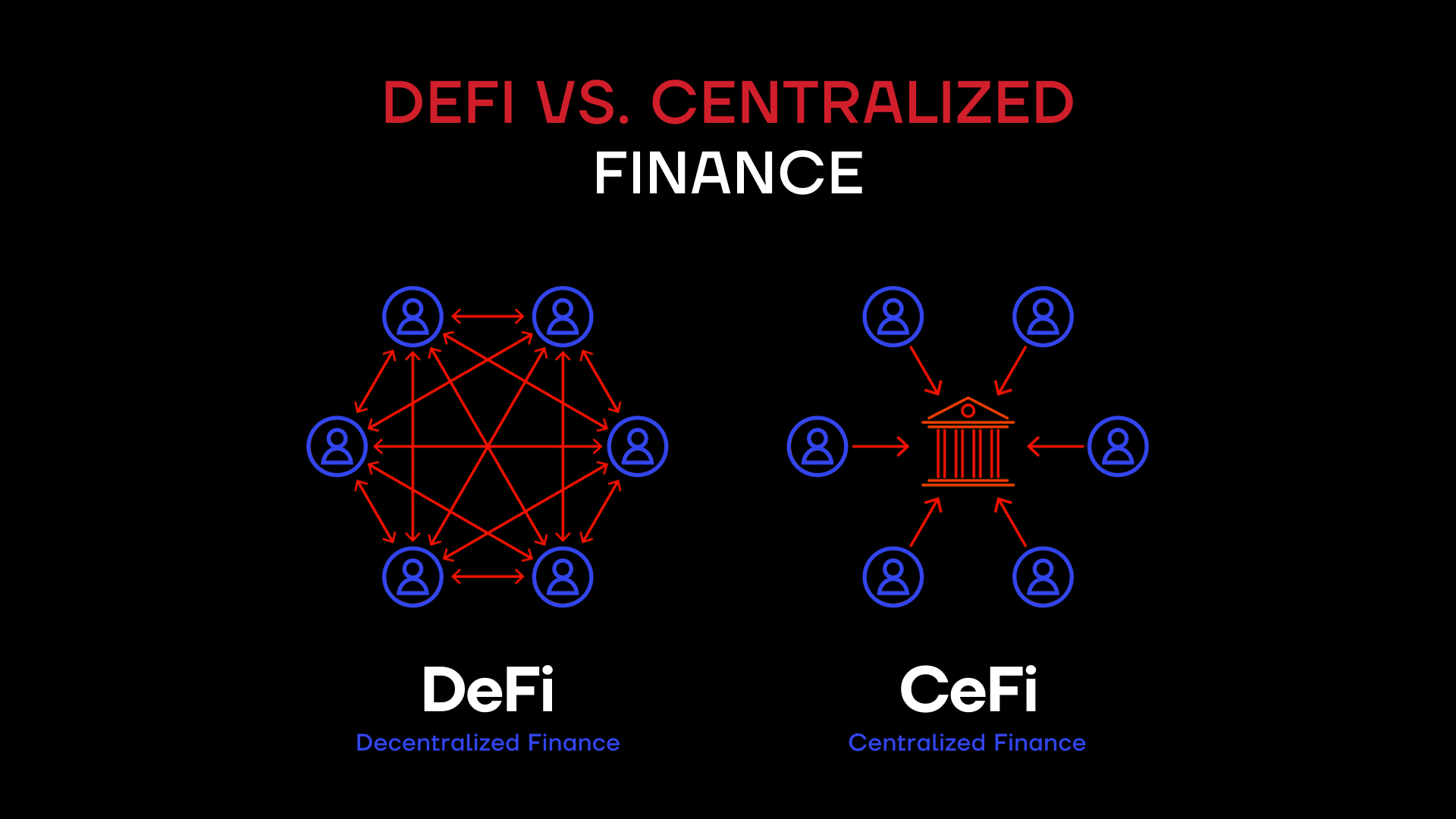

DeFi vs. centralized finance

With defi explained, let’s turn to the question of: What is decentralized finance vis-a-vis centralized? It’s hard to define defi without talking about CeFi too. As already mentioned in our defi overview above, the main differences between DeFi and CeFi or TradiFi as centralized finance is known include governance by smart contracts vs government/bank entities and the ability of everyone to participate. But there are more differences.

For example, because DeFi cuts out middlemen, it can offer lower fees on things like money transfers. It can also offer higher interest rates and yields because of the higher risk and faster growth involved in DeFi at this time.

Because DeFi is decentralized, it has a lot more room for innovation and experimentation. It is also more inclusive, allowing everyone to participate in and benefit from things that in CeFi were restricted to the rich and those from specific countries. Though the governments still control conversion to fiat and the local laws, and are known to force even DeFi companies to comply with regulations that limit who can participate in DeFi and how.

What Does Decentralized Finance Do?

What is de fi practically speaking? What does defi mean for individual and institutional investors? Decentralized finance can literally do everything centralized finance can. And not just in providing services but in regulating the financial system (local and global), helping people lend and borrow, fund and sustain communities and public projects, and self-organize in a more democratic and inclusive way.

Practically, de fi crypto finds decentralized, innovative solutions for any life situations where finance is involved. It creates and enforces new incentives. It attempts to create a system of finance that contributes to sustained and fair growth with plenty of opportunities for profit.

Advantages and Disadvantages of DeFi

The obvious advantage of DeFi is the freedom it gives to both the creators of financial products and their users. Being algorithm-based and transparent gives DeFi projects more legitimacy. DeFi’s lack of intermediaries also makes for very quick and cheap transactions, which is transformative for any financial system.

On the other hand, without a central authority protecting users, DeFi is open to a lot of security vulnerabilities such as hacking and malicious actors who rug pull their users or otherwise scam people. There is also the eternal question posed by those trying to find the defi crypto meaning: what real value does any of it have without a currency backed by actual countries with armies, etc.?

Use Cases of DeFi

While DeFi’s uses are only limited by people’s imagination, some of the earlier ones being tested now include:

- Trading

- Lending

- Money Transfers

- Collateralization

- Insurance

- Tokenization of assets

- Joint investment

- And many more

Seemingly every week, DeFi project founders come up with new use cases or twists on the old ones. Since the code of many DeFi projects is open-sourced and easy to replicate, iterations in DeFi innovation come at breakneck speed.

What Is Total Value Locked in DeFi?

According to DeFiLlama, there is currently almost $40 billion of Total Value Locked (TVL) in DeFi, with MakerDAO dominating the industry with an over 14% share of the total TVL. At the height of the previous bull market, TVL topped $161 billion.

The Future of DeFi

It’s impossible to make an awfully accurate prediction, yet it’s expected for both the TVL and use cases for DeFi to pick up and even explode in the next bull cycle. The main risk for DeFi is that the CeFi actors (banks, governments) will try to shut it down if DeFi infringes too much on their turf. There are periodically veiled or direct verbal and legislative attacks along those lines. It is also possible that DeFi will be taken down by one or many serious hacking exploits. For DeFi to be trusted, it needs to work securely, just like any other service or framework with financial implications.

On the other hand, DeFi seems to have a bright future, with an increasing number of brilliant young minds working on it, innovating better and better DeFi solutions. Even CeFi banks and hedge funds that mercilessly criticized DeFi and all of crypto mere months ago have jumped into DeFi as an investment, afraid to miss the boat of that opportunity.

Ethereum and DeFi

DeFi would be nearly impossible without Ethereum, the original defi cryptocurrency (or token, if you will) and defi network of choice. Bitcoin was the first cryptocurrency but it is not turing complete and as such its technology cannot be used to program smart contracts or be used for crypto defi. Ethereum can and has quickly become the foundation of all early DeFi projects. Even with many competitor blockchains popping up, there are still more projects on Ethereum than on all the others combined. Basically, Ethereum created the toolkit and the ecosystem for DeFi to flourish. This is how ethereum defi became the default.

However, Ethereum’s gas (transaction execution) fees were really high, which is why some projects went instead for blockchains with less decentralization but lower fees. Now that Ethereum switched from PoW to PoS consensus mechanism and significantly lowered its gas fees, it is even more dominant as the DeFi blockchain of choice. Ethereum is responsible for defi reality meaning that it was the catalyst for the first and biggest DeFi protocols.

Risks of DeFi for investors

The main risk is in DeFi finance not being regulated nor insured by default. A hack could cause the investor to lose all funds in a second. There are projects developing insurance products for DeFi and others building in various security measures. But it’s good to assume that the risk factor is higher in DeFi.

On the other hand, DeFi allows investors to participate in financial instruments directly with the wallets they own instead of trusting their funds to a bank. Those types of activities are somewhat safer. That’s what defi can give investors.

How do I make money with DeFi?

For those not afraid of the risks, there are certainly paths to making money in DeFi. First of all, there are much higher yields on fiat-currency tracking stablecoins than banks in CeFi would ever give. Then there are the more speculative yields on free-floating cryptocurrencies. Yield farming and providing liquidity in various forms could offer tremendous APR and APY (=APR compounded regularly) but with a risk of Impermanent Loss and the currency of the yield depreciating into obscurity.

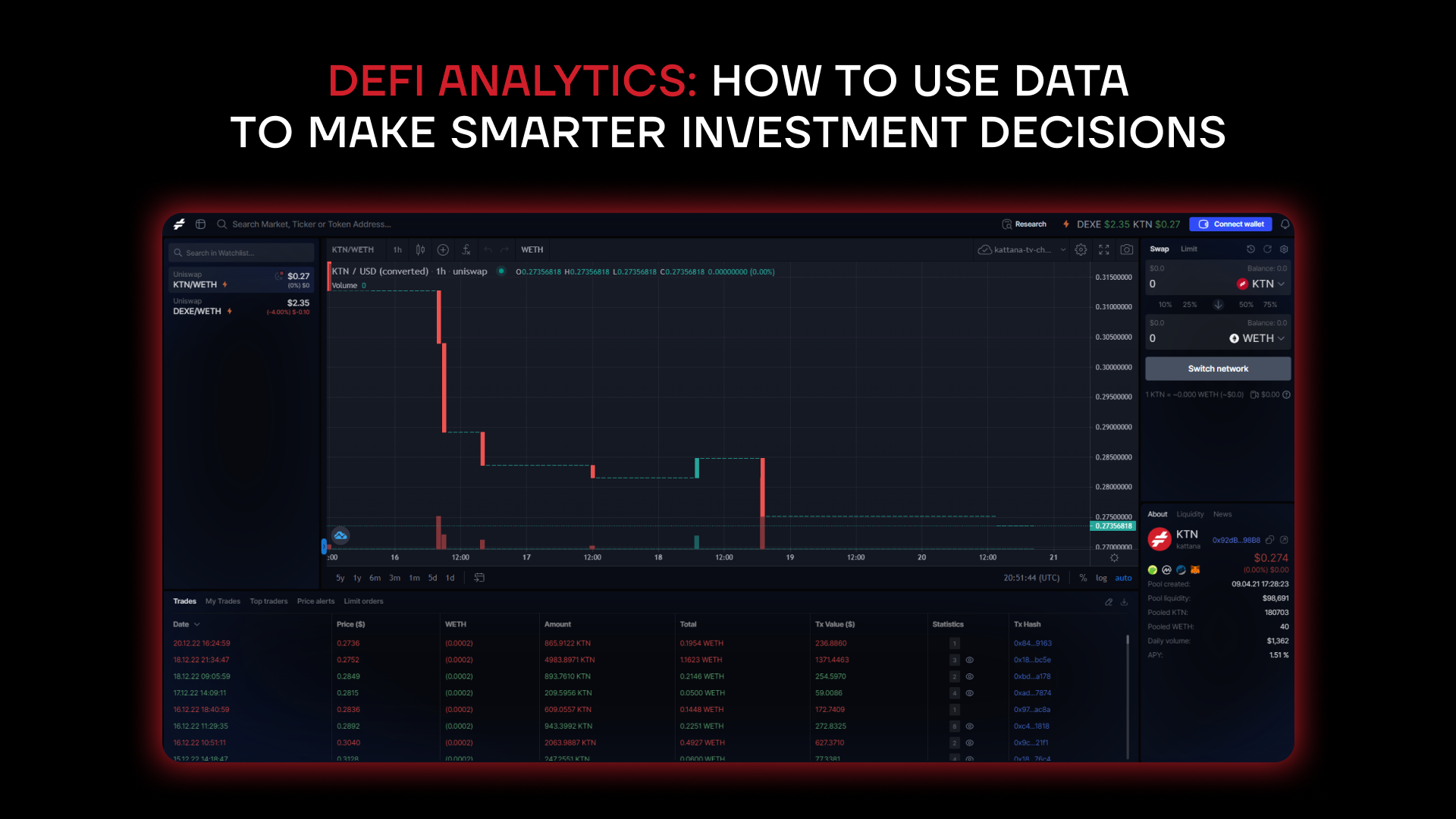

DeFi Analytics: How to Use Data to Make Smarter Investment Decisions

On a very basic level, DeFi has the same analytics and indicators as TradiFi has (and even more). On a trading platform like Kattana, use live charts, analyze the price movements, take into account relevant news, and determine the best strategy to profit from various DeFi offerings.

Additionally, there are plenty of tools and websites in the defi ecosystem aggregating information about the best yields and tracking your portfolio, like APY Vision, Zerion, and DeFi Prime.

How does DeFi challenge traditional banking?

Traditional banks are used to getting away with offering tiny yields of less than 1% on your money while charging a lot more on the loans they make. Defi banking is challenging that in a big way. A defi bank is universal, allowing people from Bangladesh to take advantage of investment opportunities in Canada with financial instruments made by a team residing in the Bahamas, Israel, and New Zealand. Or rise above cities and countries altogether.

With decentralized banking here, traditional banks could no longer justify the high fees and long delays just for moving cash from you to your family abroad when crypto can do it in minutes for practically free. Banks will have to get much more competitive and quick in order to not lose customers to DeFi alternatives.

The Bottom Line

To sum it all up, DeFi is a digital financial revolution that does everything TradiFi can do but better, faster, cheaper in many ways. Though there are plenty of risks and uncertainties involved due to DeFi being a very young industry governed by computer code, which is vulnerable to hacks and mistakes, but which can create a highly scalable, cheap, fast, and transparent (block after block) system of financial services that gives access to finance to more people in more ways than ever before.